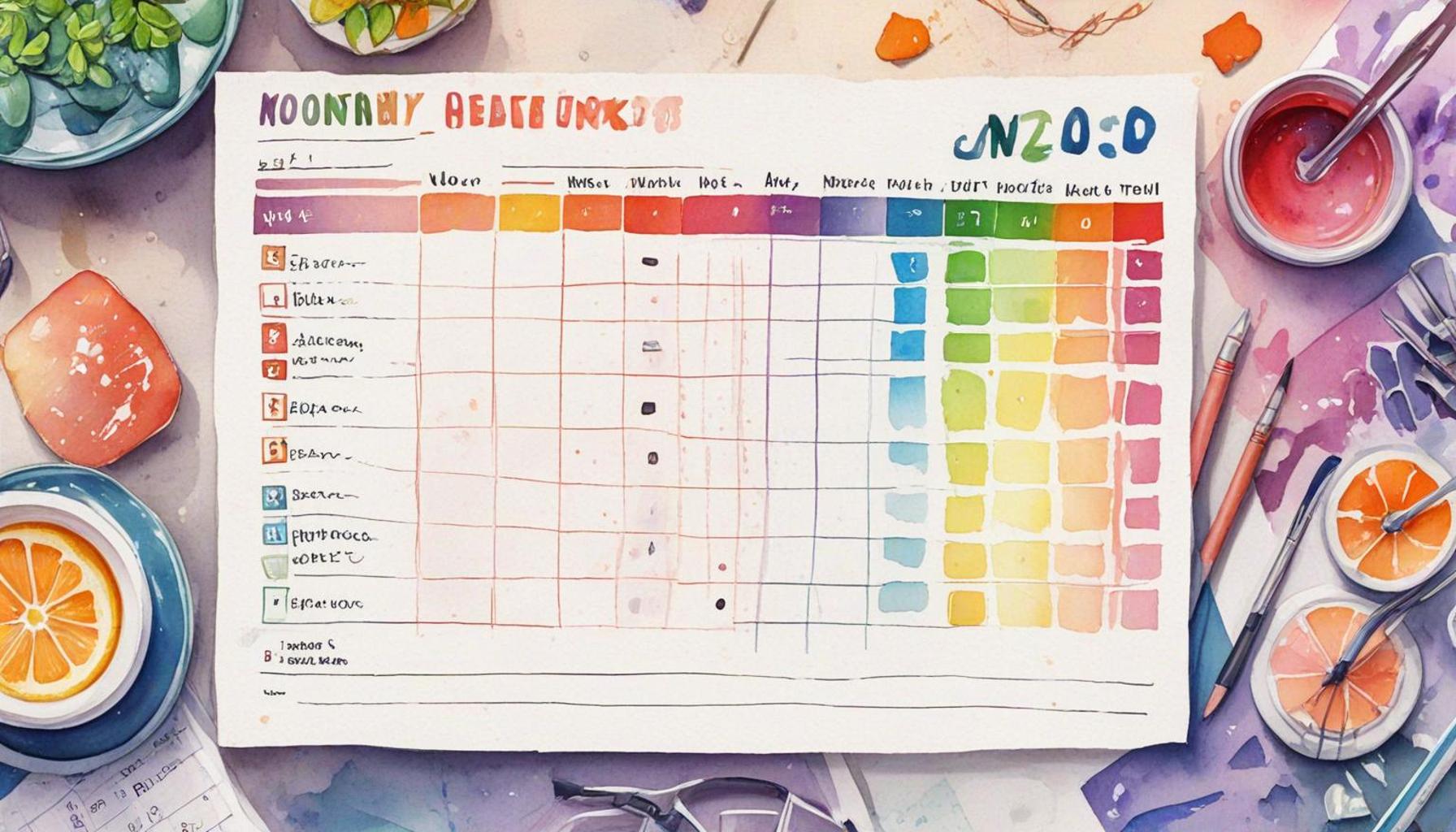

Monthly financial checklist to keep everything under control

Understanding the Importance of Financial Management

Managing your finances can often feel overwhelming. However, taking small, consistent steps each month can lead to greater control and peace of mind. One practical way to simplify this process is by creating a monthly financial checklist. This approach allows you to keep tabs on your financial responsibilities and encourages you to make proactive decisions that positively impact your financial health.

Key Components of a Monthly Financial Checklist

A monthly financial checklist encompasses several fundamental areas that require attention. Here are some essential components to consider:

- Review Your Budget: Begin by assessing your income and expenses. Compare your actual spending against your budget to determine if you’re sticking to your financial plan. For instance, if you budgeted $300 for groceries but spent $400, it’s crucial to identify where you overspent and make adjustments going forward.

- Track Your Spending: Keeping an eye on your daily expenditures helps you identify any irregular or unnecessary expenses that may have cropped up throughout the month. Utilize apps like Mint or YNAB (You Need A Budget) to monitor and categorize your spending easily.

- Pay Bills: Consistently paying bills on time can save you from annoying late fees and potential damage to your credit score. Consider setting up automatic payments for regular bills or scheduling reminders on your phone to ensure you don’t miss due dates.

- Plan for Savings: Each month, set aside a specific portion of your income for savings. Aim to build an emergency fund that can cover at least three to six months of living expenses. Additionally, consider contributing to retirement accounts, such as a 401(k) or an IRA, to prepare for your long-term financial future.

- Check Your Credit Score: Monitoring your credit score regularly is essential for discovering and resolving issues early. Services like Credit Karma provide free access to your credit report and score, allowing you to stay informed and take necessary action if you see any discrepancies.

By adhering to this checklist each month, you empower yourself to face financial challenges head-on. Establishing a routine simplifies your financial life and equips you with the knowledge to make informed decisions regarding your money.

Starting now is key to gaining confidence in your financial habits. With every checklist completed, you’ll find yourself one step closer to achieving your financial goals, whether that’s buying a home, traveling, or retiring comfortably. Remember, financial freedom isn’t attained overnight; it’s a journey built on consistency and informed choices.

CHECK OUT: Click here to explore more

Establishing Financial Control Through Budgeting

Successful money management begins with understanding your personal finances through the creation of a structured budget. A budget acts as a roadmap, guiding you through your financial landscape by making you acutely aware of your spending habits and allowing you to direct your money towards meaningful financial objectives. A solid foundation in financial management starts with a thorough examination of your income and expenses.

To begin, compile a comprehensive list of all your income streams. This includes your primary salary, any bonuses you receive, income from freelance work, investments, and passive income sources like rental properties. Knowing exactly how much money flows into your accounts each month is crucial for creating an effective budget. After assessing your income, the next step is to categorize your monthly expenses. Organize these expenses into two primary categories: fixed expenses—such as rent, mortgage payments, utility bills, and insurance premiums—and variable expenses, which include everyday costs like groceries, dining out, and entertainment. This clear delineation helps you understand where your money is going and identifies potential areas for adjustment.

The 50/30/20 Rule

To simplify your budgeting process, consider applying the 50/30/20 rule, a straightforward guideline that can help maintain a healthy balance in your finances. According to this rule, you should allocate:

- 50% of your income to needs—these are essential expenses necessary for basic living, including housing, food, transportation, and healthcare.

- 30% of your income to wants—this portion of your budget allows for discretionary spending on activities you enjoy, such as dining out, traveling, and hobbies.

- 20% of your income to savings and debt repayment—this group focuses on building your savings, investing for retirement, and paying off credit card balances or student loans.

This framework ensures you are financially sound while still enjoying life’s pleasures and preparing for future needs. For example, if you adhere to this rule with a monthly income of $4,000, you would allocate $2,000 to needs, $1,200 to wants, and $800 to savings and debt repayment, balancing your priorities effectively.

Adjusting Your Budget

Flexibility is key when managing your budget. As life unfolds, whether through a job promotion resulting in a pay raise or unexpected expenses like car repairs or medical bills, your budget should evolve accordingly. For instance, if you’ve received a raise, it might make sense to increase your savings contribution or apply a portion of your earnings towards faster debt repayment. Conversely, if you face an unexpected expense, consider trimming discretionary spending to endure the financial strain without jeopardizing your essential needs or savings goals.

Budgeting is not a one-off task; it is a continuous process. Regularly updating your budget on a monthly basis fosters financial discipline, empowering you to make informed decisions about your expenses and savings. By embracing budgeting as a habitual practice, you pave the way toward financial security and a more stable future.

In conclusion, the essence of effective financial management lies in establishing a well-defined budget. Adopting strategies such as the 50/30/20 rule, staying adaptive to changes in income and expenses, and proactively engaging with your financial circumstances will set you on a path toward achieving financial stability and fulfilling your personal achievements.

SEE ALSO: Click here to read another article

Tracking Your Spending and Reviewing Progress

Once you have established your budget, the next critical component of maintaining financial control is actively tracking your spending. This means diligently recording every purchase and expense, which can seem daunting at first but is essential for adhering to your budget and achieving your financial goals. In today’s technology-driven world, numerous apps and online platforms can simplify this process, making it easy to categorize expenses in real time. Keeping an accurate record helps identify patterns and habits that might otherwise go unnoticed.

Daily Expense Logs

One effective method for tracking is to maintain a daily expense log. Take a few minutes each night to jot down your expenditures for the day. They could range from gas fill-ups to coffee shop visits. By doing this, you can see how small, seemingly insignificant purchases add up over time. You might discover that those daily coffee runs or frequent takeout orders significantly impact your budget. For example, if your daily coffee habit costs you $5, you spend about $150 a month on just that one item— a figure that can be redirected toward your savings or debt repayment.

Monthly Financial Review

At the end of each month, set aside time to review your financial situation. Analyze your spending relative to your budget. Have you exceeded your limits in any category? If so, reflect on why this occurred and explore ways to adjust your spending moving forward. Additionally, check to ensure you are on track with your savings goals and debt repayments. A monthly financial review allows you to reassess your financial position, making necessary adjustments and developing new strategies. An effective way to conduct this review is to compare your planned expenses against your actual expenses and assess how your discretionary spending aligns with your overall financial goals.

Setting Financial Goals

As you monitor your expenses, it’s helpful to continuously set financial goals to maintain motivation. These goals can be short-term, such as setting aside money for a vacation, or long-term, like saving for a new home or retirement. By having clear objectives, you can align your budgeting and spending habits with your goals. For instance, if you aim to save $2,500 for a vacation in a year, you can create a specific monthly savings target of about $208. This approach transforms potentially overwhelming financial aspirations into manageable, bite-sized tasks.

Emergency Fund Allocation

Another vital aspect of your monthly financial checklist is establishing and maintaining an emergency fund. Financial experts often recommend saving three to six months’ worth of living expenses in a dedicated savings account to prepare for unforeseen situations such as job loss or medical emergencies. To build this fund, factor in a portion of your monthly savings—ideally from the 20% savings allocation of your budget. Consistently contributing even a small amount each month can result in a substantial safety net over time.

By diligently tracking your spending, conducting thorough monthly reviews, setting clear financial goals, and committing to an emergency fund, you will further strengthen your financial control. These practices, when incorporated into your regular financial routine, contribute to a deeper understanding of your financial landscape and ultimately lead to a more secure financial future.

SEE ALSO: Click here to read another article

Conclusion

Establishing a monthly financial checklist is a vital step toward achieving comprehensive control over your finances. By consistently tracking your spending, utilizing daily expense logs, and engaging in monthly reviews, you become more aware of your financial habits and can make informed adjustments. Remember, budgeting isn’t just about restricting yourself; it’s about enabling your financial journey towards reaching your goals.

Setting specific financial goals empowers you to focus your budgeting efforts and stay motivated throughout the month. Whether you’re saving for a vacation, a new home, or retirement, breaking down larger aspirations into monthly targets creates a clear path forward. Coupled with building an emergency fund, these practices ensure you’re prepared for unexpected turns in life, providing peace of mind and financial stability.

As you embrace these practices, keep in mind that financial management is a continuous learning process. Regularly reassess your financial position and adjust your strategies as needed. This ongoing dialogue with your finances fosters not just discipline but also confidence in your decision-making. By following a monthly financial checklist, you position yourself not just for immediate success but for long-term prosperity. Strong financial management is achievable, and with dedication and the right strategies, you can navigate your financial landscape with clarity and purpose.

Related posts:

How to Organize Your Debts in a Simple and Effective Spreadsheet

What is a broker and how to choose the right one for you

Difference between Direct Treasury and CDB for Beginners

How to Use Investment Apps for Beginners

How to use the 50-30-20 method to manage your budget

Personal Finance: Balancing Debts and Investments

Linda Carter is a writer and financial expert specializing in personal finance and financial planning. With extensive experience helping individuals achieve financial stability and make informed decisions, Linda shares her knowledge on our platform. Her goal is to empower readers with practical advice and strategies for financial success.